“We tried to do an integration with our LOS, it was a huge lift. It was awful, took a ton of human capital to get it done.”

We hear this a lot.

Custom API integrations are complex, time-consuming and can be wildly expensive.

It’s not very often that we get to bring out a new product that our bank clients will LOVE.

But today, that changed.

Realwired is proud to announce the launch of Glances, a patented integration product.

5 Integration Bank Benefits

- Integrations in weeks not several months

- A single view across multiple platforms

- Order and download appraisals from your LOS

- Extend the functionality of your legacy Core platforms

- Realwired does the heavy lift not your bank IT

Chief Digital Officers can leverage Glances to expedite integration projects on their technology roadmap.

Integrations can deplete bank IT resources. You now have an alternative to traditional integrations.

Since Realwired does the integration work, Glances allows bank IT departments to focus on more strategic initiatives, saving time and resources that would otherwise be spent on manual integration efforts.

Enhanced Efficiency for Relationship Managers

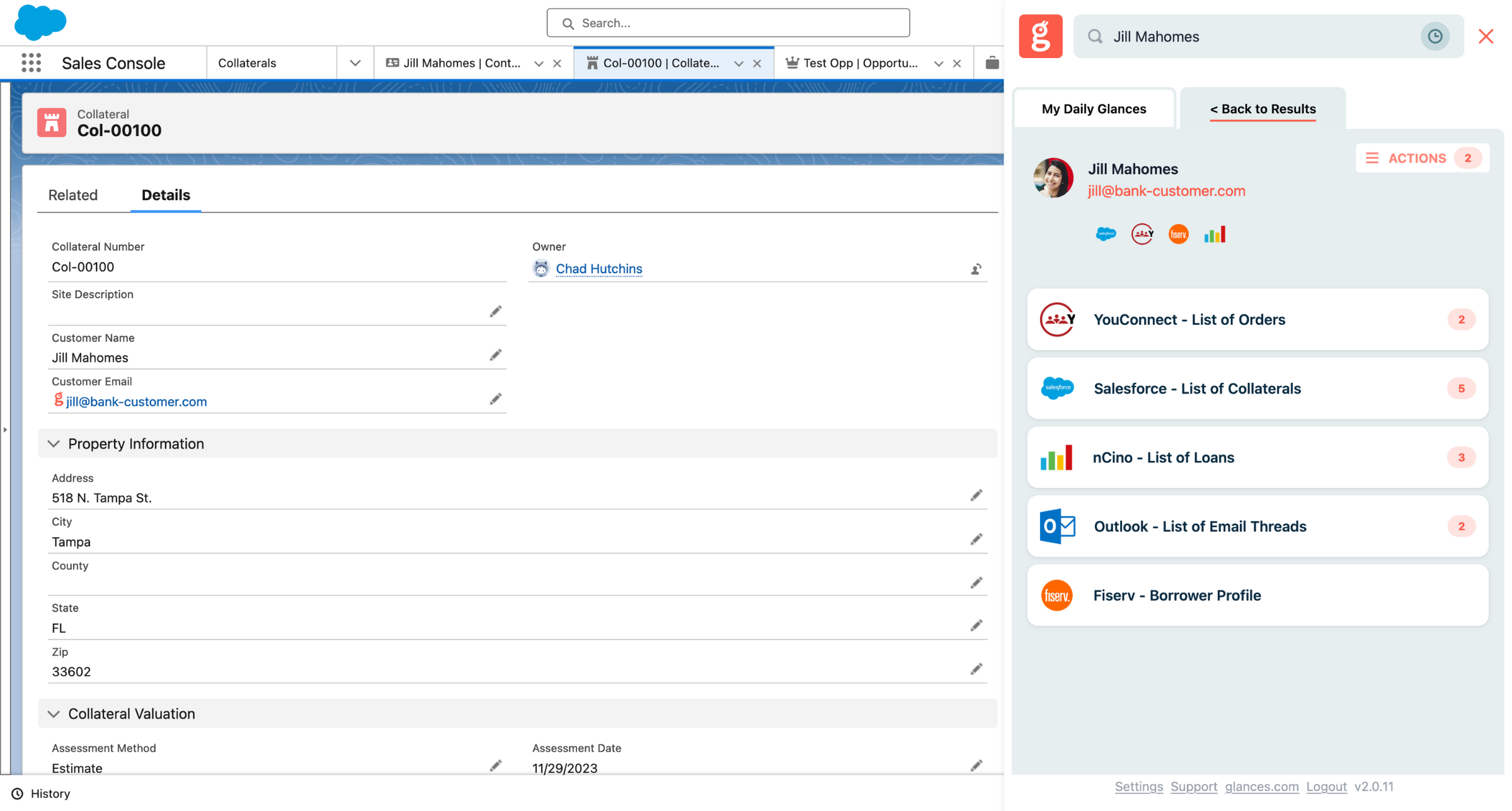

Relationship managers want to see an entire borrower’s profile in one view, including your Loan Origination System (like nCino, Abrigo, or Salesforce), Core System (like FIS or Fiserv), Outlook and Realwired’s YouConnect.

With Glances, relationship managers can click on a name in any app and obtain a comprehensive borrower profile across platforms. Instantly know the borrower’s risk rating, number of real estate loans with the bank, lines of credit and appraisals in process without the need to toggle between different programs.

Reducing Errors and Doubling Efficiency

Chief Appraisers hate errors in the appraisal ordering process. It creates double work, back-and-forth communications and wastes a lot of time.

Relationship managers can order appraisals from their LOS. Upload docs, view status, chat with Job Managers and download appraisals and invoices.

The loan and borrower data is pulled from the LOS into Glances. This eliminates double data entry and the chance of mistakes.

This, in turn, saves time and resources, allowing your loan officers to focus on more strategic tasks rather than mundane data management.

The Power of Single View Integration

Glances is not just another tool. It’s a game-changer for the banking industry.

It allows users to consolidate and view data from various systems in one place, transforming how banks operate.

By integrating Core systems, Loan Origination Systems (LOS) and appraisal platforms, Glances provides a seamless experience for users, ensuring that all vital information is accessible in a single view.

Revolutionizing Integrations Across Departments

Our clients, starting with the integration between nCino and YouConnect, have quickly realized the broader benefits of Glances.

This tool is not limited to appraisal management. It extends its utility across different departments.

Some banks want to utilize Glances with their call centers pulling in specific fields staff needs without the issues associated with full CRM access.

Keep data clean and ensure everyone across departments has the right knowledge to work their best.

From Asana to Zendesk, Glances connects with a diverse stack of business apps.

A Future of Integrated Excellence

Glances is more than just an integration tool. It’s workflow improvement, potentially bank-wide.

By embracing this innovative solution, banks can streamline their operations, reduce errors and foster a collaborative environment that drives success.

Many banks have a lot of 2024 tech initiatives but often limited IT resources.

Provide your relationship manager with modern tools to save time.

Check integrations off your list.

Check it out.